When the world places an order the mining industry delivers. But will the radical, regulatory, environmental left get out of its own way when it comes to expanded mining operations for complex green technology support?

Amazon is making quite a big deal out of their order for 100,000 Rivian electric delivery trucks . Their recent multi-media marketing blitz points to Amazon as one of the “big thinkers” of the world at a time when EV use is slated to jump from 3% to 20%.

As the self-appointed corporate guardian angel of the world’s environment, and the first corporation to sign the controversial Paris Climate Accord, Amazon isn’t shy about trumpeting its trendy “think big” green philosophy. But like much of the general public, Amazon may need to think a little bigger and dig a little deeper when it comes to the down and dirty side of environmental impact and mining support for complex, and often not-so-green technology.

With that premise in mind, the industry-watchers at Resource Erectors decided to dig up a few hard facts that just might burst the Bezos green marketing bubble when it comes to exploiting the politically correct “all electric” transition.

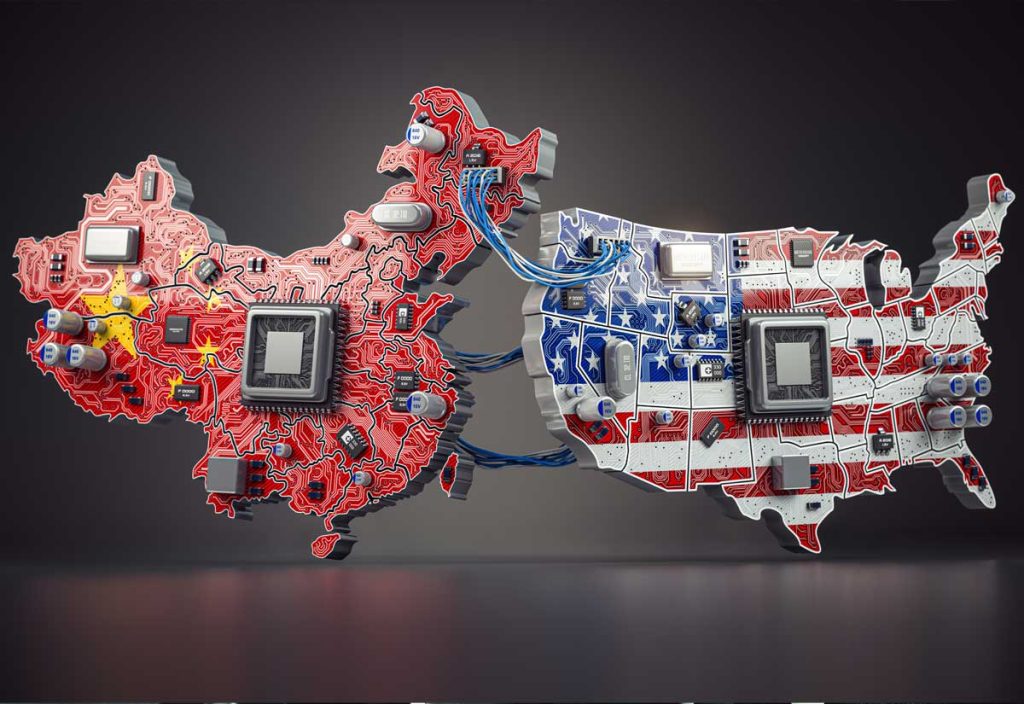

What are the deep environmental footprints of fleets like Amazon’s 100,000 EVs as they lead the global charge to meet ambitious “carbon-neutral” benchmarks over the next decades? And is “carbon saved” even a benchmark worth attaining when more severe environmental impact and energy dependence on CCP China are the trade-offs?

The Deep Environmental Footprint of Battery Electric Vehicles

Back in 2019 when Jeff Bezos placed his massive order with Rivian, a Ford backed company in which Amazon holds a 13% stake by the way, the mega-corporation’s CEO claimed that the first 10,000 vans in his EV fleet deployed by 2022 will save “4 million metric tons of carbon per year by 2030.”

For anyone familiar with the realities of mining and the energy costs for extracting those precious lithium-ion batteries, cathodes, and magnet metals, this is a laughable line in the sand. If Jeff had ordered 100,000 hydrogen fuel cell electric vehicles we might be able to buy that line, but lithium-ion battery dependent EVs are a deal breaker when it comes to overall environmental impact.

Obviously Bezos is ignoring the environmental realities of lithium-ion battery lifespans and production and the carbon generated by mining the required REE, or rare earth elements, largely with fossil fuel-powered machine operations. Not to mention the environmental impact of voracious consumption of local water resources, where a lithium mine can consume 500,000 gallons of water per metric ton produced.

According to a recent article by the Institute For Energy Research, lithium mining’s environmental impact makes the old unsubstantiated accusations about fracking’s issues seem benign by comparison.

“It is estimated that between 2021 and 2030, about 12.85 million tons of EV lithium ion batteries will go offline worldwide, and over 10 million tons of lithium, cobalt, nickel and manganese will be mined for new batteries.”- The Environmental Impact of Lithium Batteries- The Institute for Energy Research

The need to replace the first 10,000 lithium ion batteries in the Amazon EV fleet every 2 years or so is a factor that wipes those 4 million metric tons of carbon off the board all by itself.

Then there are the mountains of copper, nickel, aluminum, and cobalt for lightweight EV construction, consumed in quantities up to 10 times higher than would be required for producing equivalent gas-powered vehicles that wouldn’t need resource ravenous lithium-ion battery replacement every two years or so.

While the retail giant CEO is pretty specific about his carbon reduction numbers, the unveiling of Amazon’s new electric delivery vehicle last fall didn’t include any technical information on drivetrain, battery, range, or other relevant specifications to back up or refute Bezos’ boisterous claim. Not a problem.

At Resource Erectors we’ve been staying ahead of the green tech curve and its effects on the heavy industries we serve, so Bezos’ “4 million tons of carbon saved” boast isn’t hard to debunk based on the general state-of-the-art as we know it.

“Just one Tesla class electric car battery requires 25 pounds of lithium, 30 pounds of cobalt, 60 pounds of nickel, 110 pounds of graphite, 90 pounds of copper, and 400 pounds of steel, aluminum, and various plastic components.”- 3 Major Factors For a Precious Metals and Mining Surge in 2021- Resource Erectors

Now multiply that by 100,000, every two years. And add America’s mayors and their urban EV fleets to the green tech rush, as climate change policies enacted in 2018 come to fruition in 2021.

But will the federal government under Biden get out of the way of the essential lithium supply required to fulfill all of this green “big thinking?”

Federal Environmentalism is Once Again a Problem For Lithium Miners

Sometimes it seems as if the green left can’t get out of its own way. On the one hand, the conversion to all-electric can’t come soon enough. On the other it seems as if there is a naive belief that omelettes can be made without cracking any eggs. Or that lithium, hard to process cobalt, nickel, graphite etc. all grow on trees. The mining industry is ready to deliver in safe environmentally responsible ways, but only if the government at all levels stays clear to avoid the erosion of investor confidence.

President Trump’s previous executive orders acknowledging the ongoing mining emergency, a series of orders that streamlined the mining permit processes to reduce REE (rare earth element) dependence on CCP China by enhancing the domestic supply chain, have gone out the window under the Biden Administration.

Nevada Lithium Corp.’s Thacker Pass mine is a case in point, where two left-wing political feet are now tripping over themselves. It’s almost as if the current administration advocates total lithium dependence on China. So the green tech transition may merely be trading US oil dependence on the Middle East for “green” element dependence on CCP China.

Cutthroat trout, golden eagles, and pronghorn antelope are now trotted out in federal court, the potential “victims” of mining for lithium along the Oregon line, according to legal challenges filed by no less than 4 conservation groups in a federal lawsuit, according to a March 2021 report at the Reno Gazette Journal:

“Four conservation groups want a judge to void the expedited review of the mine under a series of Trump administration executive orders streamlining environmental regulations, especially for critical elements including lithium — a key component in electric car batteries.” – Federal lawsuit challenges construction of lithium mine approved during Trump’s final days- Reno Gazette Journal

Hopefully all this will be straightened out by 2030 when Amazon is ready to order their 1 millionth lithium ion replacement battery.

About Resource Erectors

At Resource Erectors we provide the expert human resource support to match hard-to-find professional talent with the heavy industry-leading companies that need experienced professionals in mining, civil construction, minerals and metals processing, aggregates, concrete, tunneling and more.

We recruit and place the top qualified professionals with companies in Canada, the US, and Australia and 85% of Resource Erectors’ candidates are still contributing to the success of their companies 5 years later. When you’re making a move up the career ladder or building your company’s next dream team don’t hesitate to contact Resource Erectors.