As escalating nickel prices had the world’s leading green innovator hollering for more sustainable nickel mining, it turns out that Elon Musk had some proven alternative battery technology up his sleeve.

“Iron man Elon Musk places his Tesla battery bets” the April 27 Reuters report, calls it a “pivotal development” in EV manufacturing that flew right under the Twitter acquisition clustered radar that we talked about in “The Musk Effect Part One: A Nickel For Your Tesla ” here at Resource Erectors.

Now it turns out that nearly one-half of the EV cars produced by Tesla in Q1 have no nickel in the batteries at all! Maybe we should have titled this series “The Musk Enigma”.

But let’s see if there is some discernible method to what seems to be Musk’s madness, as he sets revenue records and simultaneously closes his Shanghai plants due to supply chain failures in what’s turning out to be a tumultuous year for the world’s richest man.

Elon Plays the Lithium Iron Phosphate LFP Card

After an intense campaign and an impassioned plea to implore the mining industry to produce more essential nickel, we’re wondering if this particular Musk carrot for the major nickel mining players is still dangling from the Tesla stick:

“I’d just like to re-emphasize, any mining companies out there, please mine more nickel. Wherever you are in the world, please mine more nickel and go for efficiency, obviously environmentally-friendly nickel mining at high volume. Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.”

The LFP Alternative

Lithium iron phosphate batteries are a much cheaper alternative to the nickel-cobalt lithium batteries that dominate western markets. Now, with China’s EV consumers already making the case for Elon as they tool around the mainland in their LFP-powered Teslas, the world is ready to follow Musk’s lead and give LFP batteries a second chance. For Musk the timing couldn’t have been better for the move to LFP.

Both nickel and cobalt are battery minerals under the hammer when it comes to skyrocketing prices per ton, extraction difficulties, and human rights and environmental concerns. LFP with iron phosphate components takes both of those essential but controversial elements out of the EV battery production equation.

Just as mere rumors of the “legendary visionary” Musk’s acquisition of Twitter caused a 12% jump in the stock price, Elon’s revelation about LFP batteries already in production was a clarion call to the green energy industry.

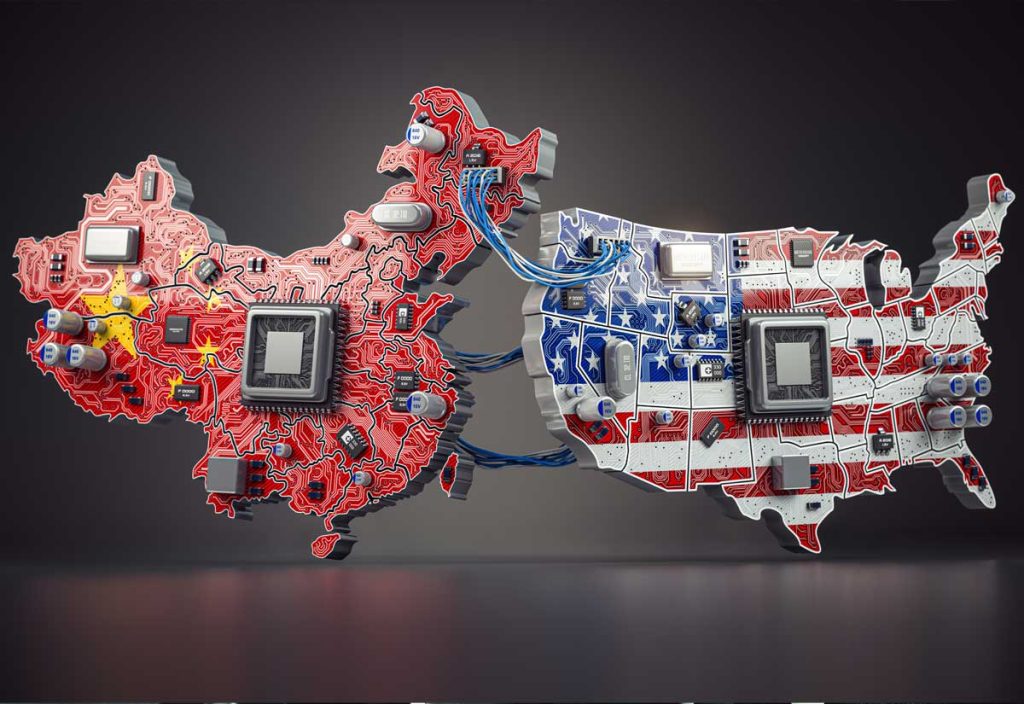

“More than a dozen companies are considering establishing factories for LFP batteries and components in the United States and Europe over the next three years”, according to a recent report. Reuters published the LFP players’ wannabe list in the report Electric Car Battery Showdown Brews in the West.

These are a few of the hopeful green energy companies, the majority of which are 2020-2021 startups betting on LFP battery production in the west by 2025:

- OUR NEXT ENERGY (ONE)- Nova, Michigan -batteries and cell packs

- MITRA CHEM Mountain View, California- LFP cathodes

- 24M Cambridge, Massachusetts- LFP and NCM cathodes and cells

- KORE POWER Coeur d’Alene, Idaho- LFP and NCM cells

- AMERICAN BATTERY FACTORY American Fork, Utah- LFP batteries

The Reuters list goes on to list 9 more companies ranging from established player Foxconn, founded in 1974 in Taiwan, to Viet Nam’s Vinfest and even Elevenses who plan to build their LFP battery facility near their headquarters in Serbia around mid-decade.

Were Russia and Ukraine the Wild Cards in Elon’s LFP Hand?

With tensions between Russia and Ukraine intensifying, Elon didn’t exactly ingratiate himself to Russia, home to Norilsk Nickel , the world’s second-largest supplier. A Twitter storm was triggered when Musk provided internet services to Ukraine via his Starlink satellite system and Russian space agency chief Dmitry Rogozin took issue with that aid.

Allegedly, Rogozin’s note to the Russian media said that Elon Musk will be held accountable for “supplying the fascist forces in Ukraine with military communication equipment”, referring to the SpaceX Starlink terminals. In response Elon famously quipped on Twitter, ‘If I Die Under Mysterious Circumstances, Nice Knowing You’.

But does Musk really need Russia and Norilsk in any case? (Russia accounts for around 20% of the world’s Class 1 nickel supply). The shift to LFP batteries combined with a high-grade domestic nickel supplier in the US may be major game-changers in the “all-electric” charge that Musk is leading.

Talon Metals Nickel Mine in Tamarack, Minnesota

Talon Metals has piled up millions of pounds of high-grade domestic nickel for the Musk EV revolution right here at home in Minnesota. The Tesla magnet metal magnate made the commitment to buy it all last January 11th according to the Bloomberg article Is This a Mine Elon Musk and Joe Biden Can Both Support?

The Minnesota project has been encumbered by the usual “environmental and tribal concerns” that are a ubiquitous burden the entire mining industry must deal with as we discussed in the Resource Erectors blog When Essential Metals and Local Heritage Collide. But that hasn’t stopped Talon from extracting cores with an impressive 9% nickel content. Brian Goldner, chief exploration officer for Talon Metals Corp. himself was impressed by the richness of the core samples saying, “It’s crazy!”

Talon characterizes the Tamarack site as the “only high-grade development stage nickel project in the USA.” Mining is projected to commence in 2026. That will help replace the missing link in the domestic nickel supply chain after the US’s only operating nickel mine in Michigan, is scheduled to shut down in 2025.

About Resource Erectors

Mining, manufacturing, minerals, metals, materials, and management.

These essentials are all at the core of the Resource Erectors heavy industry human resources mission. We bring decades of recruiting and placement experience in the diverse sectors of heavy industry including mining, minerals processing, engineering, civil construction, concrete, aggregates, construction materials, and engineering in every field.

When you’re ready to move up your company or advance your professional career you’re ready for Resource Erectors so don’t hesitate to contact us today.