Despite Declining Auto Sales, Industry Demand For Palladium Rose 2% in 2019

Stricter emissions regulations around the globe are sustaining the palladium rally of the past decade and precious metals experts at Metals Focus are predicting that the metal so vital for efficient catalytic converters will continue to rally strong in 2020.

Stringent regulations now in effect, especially in densely populated China, nullified the 2019 drop in car sales due to increased PGM loads in vehicle catalytic converters across the board. Fewer cars running cleaner still require even more precious palladium.

At Resource Erectors we’ve been keeping a close eye on the Platinum Metals Group and, today, it’s still correct to say that palladium is more precious than ever.

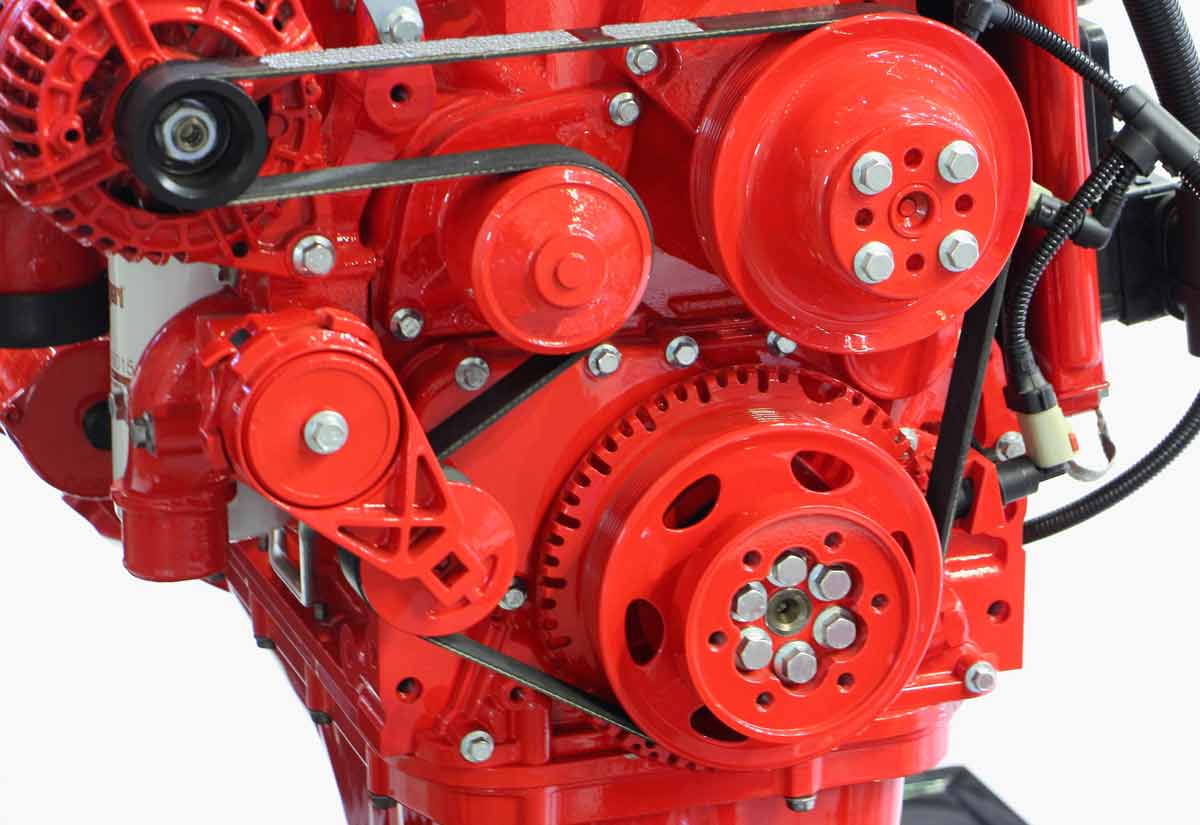

PGM (Platinum Metal Group) Loading in Catalytic Converters

In 2019, Platinum Group Metals (PGM) loadings per vehicle increased to such an extent that above-ground palladium inventories available to satisfy this voracious global demand dropped to just 14 months by the end of 2019, as compared with a 24-month supply available just a decade ago in 2010.

The Metals Focus group anticipates a doubling of the palladium deficit in 2020, reaching a 4-year demand high in an “increasingly tight physical market.”

As even more stringent emissions regulations come into effect higher PGM loads will be required in both gasoline and diesel-powered vehicles. An informative article at Johnson Matthey Technology Review points out that the majority of gasoline-powered vehicles use a palladium-rhodium combination. Up to 7 times more palladium than rhodium is required for typical gasoline-powered auto-catalyst applications globally.

Even in diesel-powered vehicles, the metal formulation doesn’t vary much and still requires palladium for a platinum-palladium catalyst combination.

The average PGM load is 4 to 5 grams per car but large high-powered vehicles can require as much as 15 grams or more.

High Palladium Prices and High Demand Attracts New Players in the Mining Industry

The global demand for better environmental performance has driven global palladium production to outpace even gold.

According to statistics reported at miningtechnology.com, global palladium production soared to 214 tons in 2017, easily surpassing gold production at just 175 tons for that year. The palladium boom has spot bid prices well above $2,000/ounce at the time of this writing in February 2020, up from $562.98 at the end of 2015.

Even amidst the inevitable volatility which occurs with any hot commodity, palladium prices have quickly recovered after rounds of short-term profit-taking. Now a $200 dip is often viewed as a buying opportunity for investors looking to get in on the palladium rush.

Resurgent palladium prices have mining companies refocusing on profitable palladium operations and a sustained supply chain for the near future. North American Palladium launched an 8-year plan in 2019 to continue underground operations with an ambitious production target of 2.32 million ounces by 2027. Palladium brought new life to the the Lac Des Illes mine in Canada, when lucrative prices made it feasible to restart production in 2010 after a 2-year shutdown.

New specialized palladium operations are now drawing heavy investment from US-based Platinum Metals Group which is launching its new Waterburg mine in South Africa. The initial $847 million investment is projected to produce a whopping 420,000 ounces of palladium per year. Secure financial backing from industry giants Implats and JOGMEC boosts confidence that the Waterburg Mine will continue to pour out precious palladium for the next 45 years.

New low-cost, high-production operations such as that anticipated for the Waterburg Mine, and restarted operations driven by high demand and high prices could combine to “challenge the monopoly” of Russia-based Norilsk Nickel, which generated the majority 41% of the world’s palladium supply in 2017.

The high price is also driving a $3 billion “parallel industry” for recycling palladium from older vehicles, one that provided 41 tons in 2010 to help fill the palladium deficit while large scale palladium mining operations slowly gain traction after a decade of under funding.

As the world continues to move toward cleaner emission control from gasoline-powered vehicles, with small gas engines in hybrids expected to make up 20% of the worlds automotive power train, and large diesel vehicles requiring a palladium-platinum catalytic combination, the future for palldium demand for the 2020 decade is strong.

Mining For Precious Human Resources at Resource Erectors

Just as the palladium supply is “physically tight” and in record-high demand, so is the supply of top professional candidates in the mining industry, civil construction, tunneling, engineering, and manufacturing.

At Resource Erectors we bring industry-specific experience to the table to match the most highly qualified professionals with North America’s industry leaders who are ready and eager to put their talent to work.

Whether you’re building your company’s dream team or you’re a professional eager to make a strategic move up the career ladder, Resource Erectors is standing by with 20 years of human resource expertise, so don’t hesitate to contact us.