Communist Red China is at it again. But have they pushed the green mineral profiteering envelope too far?

With near-monopoly chokeholds on the majority of essential battery and magnet minerals, Red China poses the greatest threat to overshooting the 1.5°C benchmarks that so many organizations in the West have pledged to uphold.

Red China’s recent announcement of export controls on both natural and synthetic graphite under the guise of “national security” is just another example of unethical trade policies that bring this troubling issue into stark focus as we wrap up October 2023.

“Many private manufacturers [in China] are struggling to restore production, yet more than 95% of some 20,000 industrial companies controlled by the central government are churning out masks, medicines, steel, heavy machinery and other products—keeping workers on the job.” Wall Street Journal- China’s Coronavirus Response Toughens State Control and Weakens the Private Market

As industry still recovers from the Covid 19 debacle launched by who else, the avaricious Red state thugs of China, these most recent draconian export controls could have far-reaching implications for industries relying on Chinese graphite, especially as the globe moves relentlessly, and many engineers say recklessly, towards a greener economy.

Another Chinese choke point in the essential metal and mineral supply that is the chain that turns on the lights and keeps the world up and running is the last thing global industry needs right now. As we’ll see shortly, the world’s industries are responding.

The Immediate Impact of Communist Market Manipulation Policies in China

The immediate, and obvious effect to anticipate for Q1 2024 is a potential scarcity of graphite feedstock products for overseas companies. Many of these companies, particularly anode producers in countries like South Korea, are reliant on imports of spherical graphite from China. But South Korea is not alone, according to the alarming data from Benchmark Mineral Intelligence.

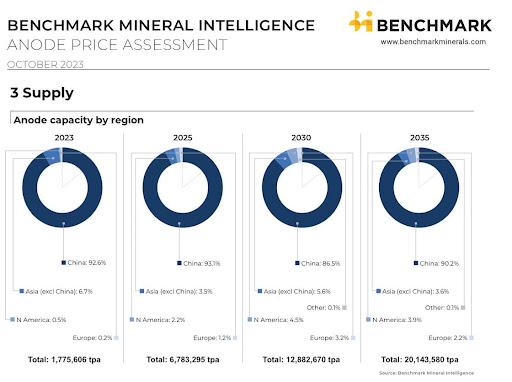

The announcement of new restrictions on graphite exports by the Chinese government has caused strong industry reaction across the world. Security and quality of supply is under an even brighter spotlight than before – and Benchmark data illustrates why:

-

2023 global anode capacity – China accounts for 92.6%

-

2035 projected global anode capacity – China accounts for 90.2%”-

Data provided by Benchmark Mineral Intelligence Alert newsletter.

The stringent interference in global free market trade by communist policy-makers on export permits could result in a drastic increase in production costs for heavy industry companies around the world, potentially leading to downstream effects on already inflated consumer prices for electric vehicles and other battery-powered devices.

China Blows Another Headwind Against the Global Green Transition

The ubiquitous “green transition” is already facing serious headwinds in 2023. Fact-based engineering know-how about the reality of EVs is slowly but steadily spreading to the mainstream consumer sector, if not the c-suite green-washed bubbles. The hard energy truth is inevitably catching up to the barrage of elitist green marketing propaganda that has close to “net zero” science behind it but has bombarded the masses masquerading as fact for decades.

At least, there’s not enough conclusive scientific evidence from observations of one century of an Earth history estimated to be around 4.54 billion years old, based on evidence from radiometric age-dating of meteorite samples. Of course that doesn’t ease the minds of the greensters who go all Chicken Little over the 6th warmest year of 2022, when the temperature crawled up by .86 C degrees over the 20th Century average.

One century of arguably man-made climate change, a conclusion dubiously drawn from one century of “recorded temperature evidence” is used to justify the false sense of urgency that has made commodities out of common metals and minerals, and enabled greenster thug economies such as Red China’s.

Earth’s temperature has risen by an average of 0.14° Fahrenheit (0.08° Celsius) per decade since 1880, or about 2° F in total.- climate.gov

Shrugging Off China’s Chokehold on the Critical Mineral Pipeline

With the viral word on the consumer street circulating on the web, the deterrent cost to the workforce class of up to $20,000 replacement batteries for today’s EVs, and bleak energy density power grid numbers that just don’t crunch, the hybrid communist/ capitalist policies of China are quickly becoming intolerable.

For the heavy industry world that learned some hard lessons about fickle Chinese supply chain reliability and communist duplicity in shutting down or nationalizing private industrial enterprises during the Covid 19 crisis, it might be high time for an Ayn Rand style “Atlas Shrug”.

But this time with heavy industry’s major players such as Boeing, Apple, Caterpillar, and Ford all vanishing from under the oppressive green thumb of Red China’s disastrous communist/capitalist mongrel business ethics, yet another net zero tally, this time in the fair trade ethics column.

In the meantime the worldwide heavy industry sector is already going shovel-ready to build reliable domestic critical mineral supply chains to significantly reduce, if not eliminate altogether, reliance on rusty Red supply chains. This partnership is more crucial than ever, as we see China’s graphite gangsters make their latest grab for the green.

The Minerals Security Partnership Announces Support for Mining, Processing, and Recycling Projects

According to the state.gov post Joint Statement on the Minerals Security Partnership, it’s long past time to forge some new critical supply chains. Eleven projects in upstream mining and mineral extraction, four projects in midstream minerals processing, and two projects in recycling and recovery will be catalyzed and financed by the 14 international partners in the MSP.

The Minerals Security Group includes member partners from emerging minerals economies, and a range of private sector organizations. Representatives from Australia, Brazil, Canada, the European Commission, Finland, France, Germany, India, Indonesia, Italy, Japan, Kazakhstan, Mongolia, Norway, the Republic of Korea, Sweden, South Africa, the United Kingdom, the United States, and Zambia all participated in a forum this past October 10, 2023.

Proposals included one project focusing primarily on lithium; three on graphite; two on nickel; one on cobalt; one on manganese; two on copper; and seven on rare earth elements.

Five projects will break ground in the Americas, seven projects in Africa, three projects in Europe, and two projects in Asia-Pacific.

The Financial Repercussions of China’s Export Restrictions

For a commodity such as graphite, one that has seen a price drop of approximately 30.8% in 2023 alone, as assessed by Benchmark, these export restriction chokepoints for the rest of the world could well serve as a price inflation mechanism for China.

It’s important to remember that even before the Maoist brainwashing that saturates the good people of China, the Chinese cultural mentality has always seen the hierarchy of the universe as Heaven, China, and everyone else in the world at the bottom rung of entitlement. So it’s a rather easy task for the current communist elite to throw fuel on that ethnocentric spark.

This blatant profiteering move by avaricious communist leaders will most certainly come at the expense of industries worldwide that are already grappling with inflationary pressures. Happily many of our heavy industry leaders in the US and Canada are already hard at work developing the domestic essential mineral supply chains that could let us shrug off dependence on fickle, even volatile, communist policies once and for all.

The Long-term Picture

Despite the immediate challenges, these most recent export controls in China could act as a catalyst for change in Western nations. Legislation such as the Inflation Reduction Act in the US has already been providing support for domestic battery anode supply chain development. China’s abhorrent mineral export policies could accelerate this trend, encouraging heavy industries to be less reliant on a single, politically volatile source for essential materials.

Alternatives and Supply Chain Innovations

The situation also underscores the importance of diversifying the supply chain and investing in recycling technologies for battery materials. Companies like Li-Cycle and Redwood Materials are set to benefit from European policies that are leaning towards targets on recycled content. The U.S. and EU are taking steps, albeit different ones, to secure their supply chains via recycling, and this could be a viable path forward for heavy industry professionals.

The Takeaway

In the push for greener technologies and sustainable futures, China’s latest felonious actions serve as a grim reminder of the geopolitical complexities that intertwine with industrial needs. The implications of this move could reverberate across various sectors, pushing organizations worldwide to reassess their strategies, possibly at the expense of their climate-worshiping green initiatives.

But it could also serve as the nudge that the West needs to accelerate its own supply chain capabilities, innovate, and turn a challenge into an opportunity.

About Resource Erectors

For heavy industry professionals seeking career opportunities that align with the world’s shifting industrial landscape, Resource Erectors is here to guide you every step of the way. We never shrug off our mission to recruit and provide the top engineering and heavy industry professionals for mining, aggregates, infrastructure, and heavy civil engineering for the industry leaders who seek their experience and talents, so don’t hesitate to contact Resource Erectors so we can all get to work.