Pump it up! Underground Mining Will Always Be a Challenge-Part 1

“All energy-producing machinery must be fabricated from materials extracted from the earth. No energy system, in short, is actually “renewable,” since all machines require

“All energy-producing machinery must be fabricated from materials extracted from the earth. No energy system, in short, is actually “renewable,” since all machines require the continual mining and processing of millions of tons of primary materials and the disposal of hardware that inevitably wears out. Compared with hydrocarbons, green machines entail, on average, a […]

The fragility of the global metals supply chain exposed by the pandemic shutdowns will continue to be the leading factor contributing to uncertainty in industries across the board. Now as the scramble to recover continues in 2022, the global metals supply chain could be tightening even further.

Hydrogen vs. Lithium: Let’s get ready to rumble! Last year we witnessed a notorious, knock-down-drag-out, public relations battle between two of the world’s most powerful and influential green energy moguls; even though the two billionaire contenders were never in the same room. Now the hydrogen sector of the green energy industry is swinging back hard.

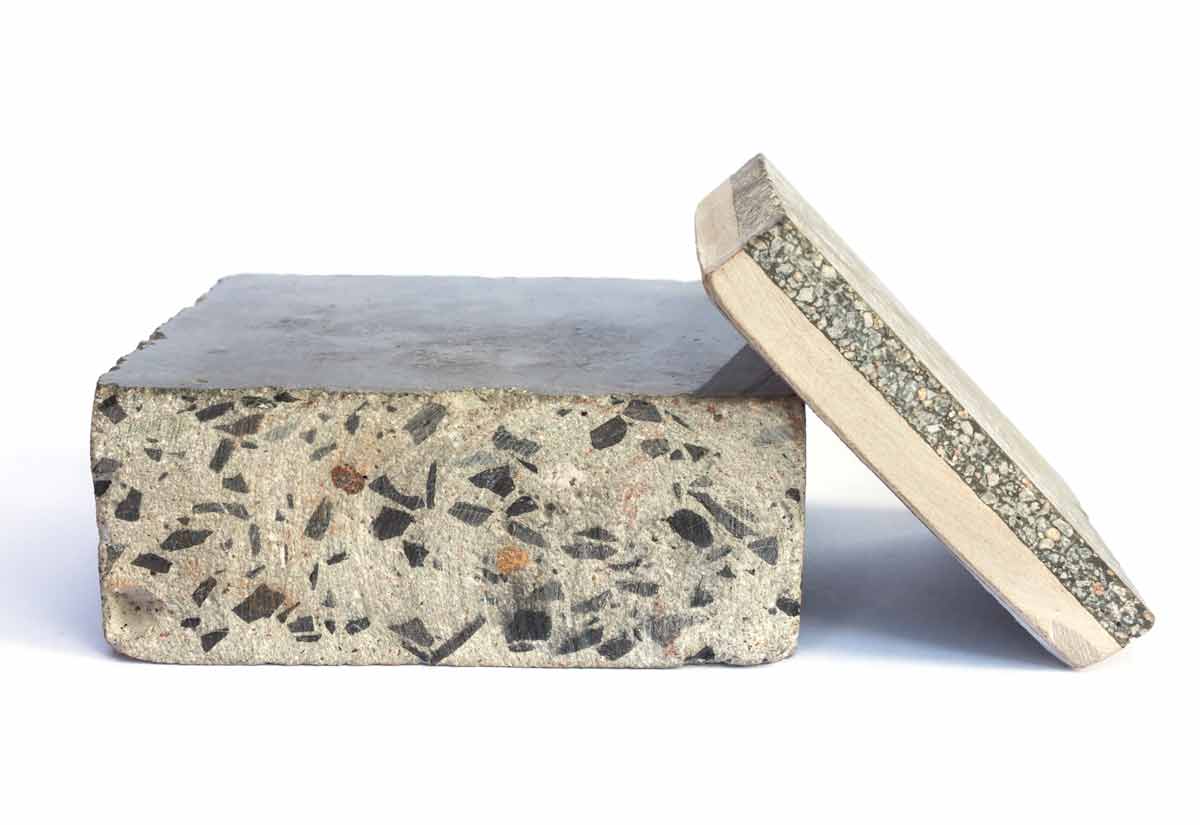

Resource Erectors Industry Innovation Watch Q4 2021 Unless you’ve been living under an uncrushed rock yourself, it’s not breaking news for heavy industry professionals that the demand for metals, minerals, and construction aggregates is reaching unprecedented levels in industrial sectors across the board. Affected industries range from precast concrete to civil and residential construction, […]

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices are presently at all-time highs and set to continue on their upward trajectory as demand continues to outstrip supply.”- Battery Metals Supply Shortage – Miners Win, Lithium-Ion Battery Makers Lose […]

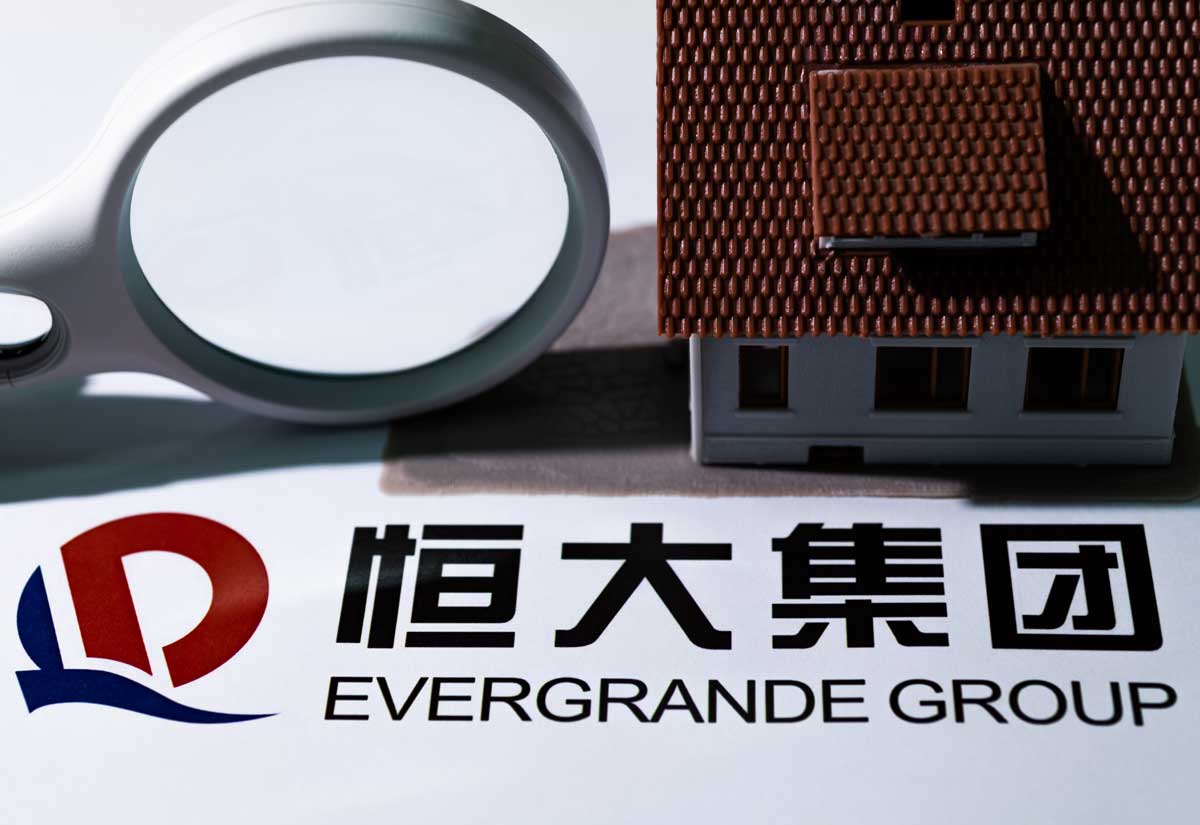

Resource Erectors Q4 2021-2022 Heavy Industry Review Part 1 China is facing soaring raw material costs, weakened manufacturing, a widespread power shortage, and the explosive Evergrande Effect in the real estate sector. This November the inevitable Evergrande collapse looms large and ripple effects from China are beginning to rumble throughout the global economy. But […]

Industry Watch at Resource Erectors Q4 2021 And we thought Jeff Bezos’ benchmark order for 100,000 Amazon delivery EVs by 2030 was ambitious? Now, like a Phoenix rising from the ashes, recently bankrupt Hertz has announced that it will buy 100,000 Tesla Model 3 small cars by the end of 2022. In accordance with […]

Innovation Watch at Resource Erectors Part 3 At Resource Erectors the 5G rollout has been one both we and the mining industry have been anticipating for years now if not for decades. As far as innovations go, the 5G private network rollout is the tech story of 2021, especially for “smart” industrial applications. As they […]

“With each new pledge and plan to accelerate renewable energy deployment and build the homegrown electric auto industry of tomorrow, we are financing enormous mineral demand while doing little more than paying lip service to building the industrial base needed to supply it.”- Katie Sweeney-Billings Gazette

“Advances in overland conveying technology have improved efficiency, reduced capital and operating costs, and made the conveying process more environmentally friendly and sustainable. One important metric that supports this is the cost for transporting material, which is $2 – $3 less per ton using overland conveying compared to trucking, factoring in capital expense and […]

“It would be wonderful if you could make your plant maintenance-free. You can’t. But cone crushers, screens, conveyors, everything involved is more maintenance-free.”- Aggregate Specialist DAN JOHNSON- Interview at Pit and Quarry Crushing, Conveying, and Screening Goes High Tech Technology solutions for the aggregates industry are providing more actionable data to improve processes and […]

Resource Erectors Tech Update 2021 Part Two “Where no miner has gone before” makes a great headline but truthfully the 2021 robotic workforce is more accurately described as “going back to where no human miner can return”, at least for the lucrative extraction stage of the mining process. While robotics are finally taking center […]

“All energy-producing machinery must be fabricated from materials extracted from the earth. No energy system, in short, is actually “renewable,” since all machines require

The fragility of the global metals supply chain exposed by the pandemic shutdowns will continue to be the leading factor contributing to uncertainty in

Hydrogen vs. Lithium: Let’s get ready to rumble! Last year we witnessed a notorious, knock-down-drag-out, public relations battle between two of the world’s most powerful

Resource Erectors Industry Innovation Watch Q4 2021 Unless you’ve been living under an uncrushed rock yourself, it’s not breaking news for heavy industry professionals

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices

Resource Erectors Q4 2021-2022 Heavy Industry Review Part 1 China is facing soaring raw material costs, weakened manufacturing, a widespread power shortage, and the

Industry Watch at Resource Erectors Q4 2021 And we thought Jeff Bezos’ benchmark order for 100,000 Amazon delivery EVs by 2030 was ambitious? Now,

Innovation Watch at Resource Erectors Part 3 At Resource Erectors the 5G rollout has been one both we and the mining industry have been anticipating

“With each new pledge and plan to accelerate renewable energy deployment and build the homegrown electric auto industry of tomorrow, we are financing enormous mineral

“Advances in overland conveying technology have improved efficiency, reduced capital and operating costs, and made the conveying process more environmentally friendly and sustainable. One

“It would be wonderful if you could make your plant maintenance-free. You can’t. But cone crushers, screens, conveyors, everything involved is more maintenance-free.”- Aggregate

Resource Erectors Tech Update 2021 Part Two “Where no miner has gone before” makes a great headline but truthfully the 2021 robotic workforce is

© 2025 Resource Erectors