5 Golden Years. When Experience Pays at Resource Erectors

Six-figure Engineering Job #504 Job #501 April 4, 2022 In this article we’ll shine the job spotlight on the next class up from the

Six-figure Engineering Job #504 Job #501 April 4, 2022 In this article we’ll shine the job spotlight on the next class up from the “young guns” of engineering in the industrial recruiting hierarchy, the senior management heavy industry professionals. We’ll explain why those 5 years or more of demonstrated leadership and continuous improvement experience […]

The Industrial Green Giant in 2022 Part 3 at Resource Erectors It wasn’t too long ago that we were wondering whatever happened to CCT developments, the Clean Coal Technology that yanks the green rug out from under the rock-solid feet of the not-so-jolly global Green Giant pushing a “green agenda” based on non-science and […]

Producers of concrete, steel, lead, zinc, copper, and just about any other material essential to building and maintaining a robust infrastructure are the industrial scapegoats continuously under fire from the not so jolly Green Giant of global environmental policies. Heavy industry PR in the Green Giant era today, focuses on exorcising the now universally […]

Resource Erectors Industry Watch: February 2022 Part 1 The consensus in the industrial world by February 2022 seems to regard 2021 as the year when companies across the board “got serious” about hitting ambitious Scope 1 and Scope 2 “carbon-zero” benchmarks. Corporations are ante-ing up with millions on the green energy table backed up […]

Hydrogen vs. Lithium: Let’s get ready to rumble! Last year we witnessed a notorious, knock-down-drag-out, public relations battle between two of the world’s most powerful and influential green energy moguls; even though the two billionaire contenders were never in the same room. Now the hydrogen sector of the green energy industry is swinging back hard.

It’s called the NIMBY effect and no global industry is more universally challenged by “Not In My Back Yard” opposition than the mining and quarry sectors. Except perhaps the nuclear power industry, and in either sector, rarely is the opposition justified.

Resource Erectors Industry Watch Q4 2021 24/7 optimized production is the rule in construction aggregates rather than the exception now. Aggregate operations by the end of 2021 are under the gun and have no time for downtime. Not with a market share of nearly $74 billion on the table over the next 5 years. […]

If you accept the evaluation of the folks over at Weedlife, hemp is the “dream green” construction material. But can the US make the industrial hemp transition? In 2018 President Trump signed the 2018 Farm Bill that legalized hemp as a legitimate agricultural and industrial product. That bill revived the long-lost US hemp industry […]

Resource Erectors Industry Watch Q4-December 2021 The industry watchers here at Resource Erectors were happy to see the 11 November press release from construction materials and energy industry giant Saint-Gobain, announcing a substantial 400 million USD investment earmarked for expanding the US gypsum industry and more in the domestic construction materials sector. According to the […]

Resource Erectors Industry Innovation Watch Q4 2021 Unless you’ve been living under an uncrushed rock yourself, it’s not breaking news for heavy industry professionals that the demand for metals, minerals, and construction aggregates is reaching unprecedented levels in industrial sectors across the board. Affected industries range from precast concrete to civil and residential construction, […]

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices are presently at all-time highs and set to continue on their upward trajectory as demand continues to outstrip supply.”- Battery Metals Supply Shortage – Miners Win, Lithium-Ion Battery Makers Lose […]

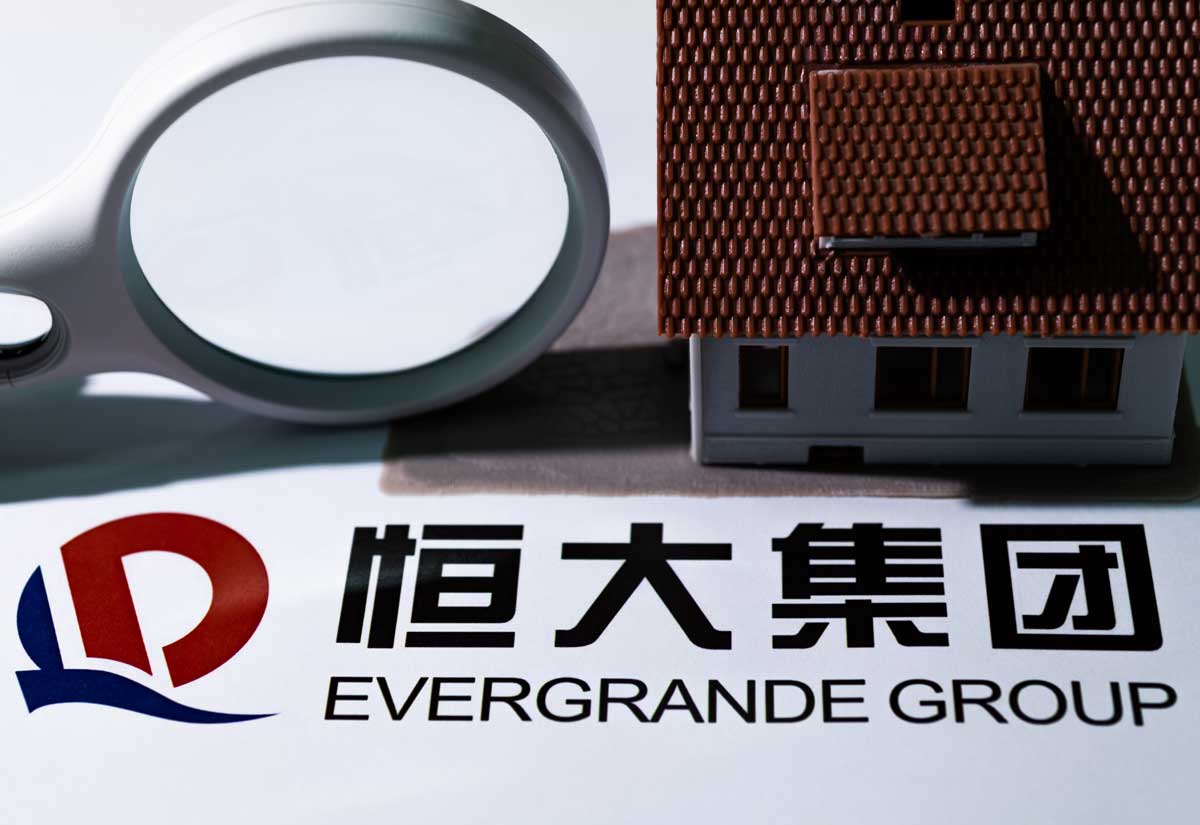

Resource Erectors Q4 2021-2022 Heavy Industry Review Part 1 China is facing soaring raw material costs, weakened manufacturing, a widespread power shortage, and the explosive Evergrande Effect in the real estate sector. This November the inevitable Evergrande collapse looms large and ripple effects from China are beginning to rumble throughout the global economy. But […]

Six-figure Engineering Job #504 Job #501 April 4, 2022 In this article we’ll shine the job spotlight on the next class up from the

The Industrial Green Giant in 2022 Part 3 at Resource Erectors It wasn’t too long ago that we were wondering whatever happened to CCT

Producers of concrete, steel, lead, zinc, copper, and just about any other material essential to building and maintaining a robust infrastructure are the industrial

Resource Erectors Industry Watch: February 2022 Part 1 The consensus in the industrial world by February 2022 seems to regard 2021 as the year

Hydrogen vs. Lithium: Let’s get ready to rumble! Last year we witnessed a notorious, knock-down-drag-out, public relations battle between two of the world’s most powerful

It’s called the NIMBY effect and no global industry is more universally challenged by “Not In My Back Yard” opposition than the mining and quarry

Resource Erectors Industry Watch Q4 2021 24/7 optimized production is the rule in construction aggregates rather than the exception now. Aggregate operations by the

If you accept the evaluation of the folks over at Weedlife, hemp is the “dream green” construction material. But can the US make the

Resource Erectors Industry Watch Q4-December 2021 The industry watchers here at Resource Erectors were happy to see the 11 November press release from construction materials

Resource Erectors Industry Innovation Watch Q4 2021 Unless you’ve been living under an uncrushed rock yourself, it’s not breaking news for heavy industry professionals

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices

Resource Erectors Q4 2021-2022 Heavy Industry Review Part 1 China is facing soaring raw material costs, weakened manufacturing, a widespread power shortage, and the

© 2025 Resource Erectors