The fragility of the global metals supply chain exposed by the pandemic shutdowns will continue to be the leading factor contributing to uncertainty in industries across the board. Now as the scramble to recover continues in 2022, the global metals supply chain could be tightening even further.

As nations around the globe are in a position to reap unprecedented, record-setting profits from the minerals and metals they export, the metals supply chain could actually get weaker instead of stronger.

While battery essentials such as lithium, cobalt, and nickel get their share of the industrial spotlight, price spikes induced by a supply chain stretching under the strain of increasing demand is a rising tide that raises all ships.

Indonesia is a recent case in point, and their ship happens to be made of tin.

Indonesian Tin: A Typical Supply Chain Kink For 2022

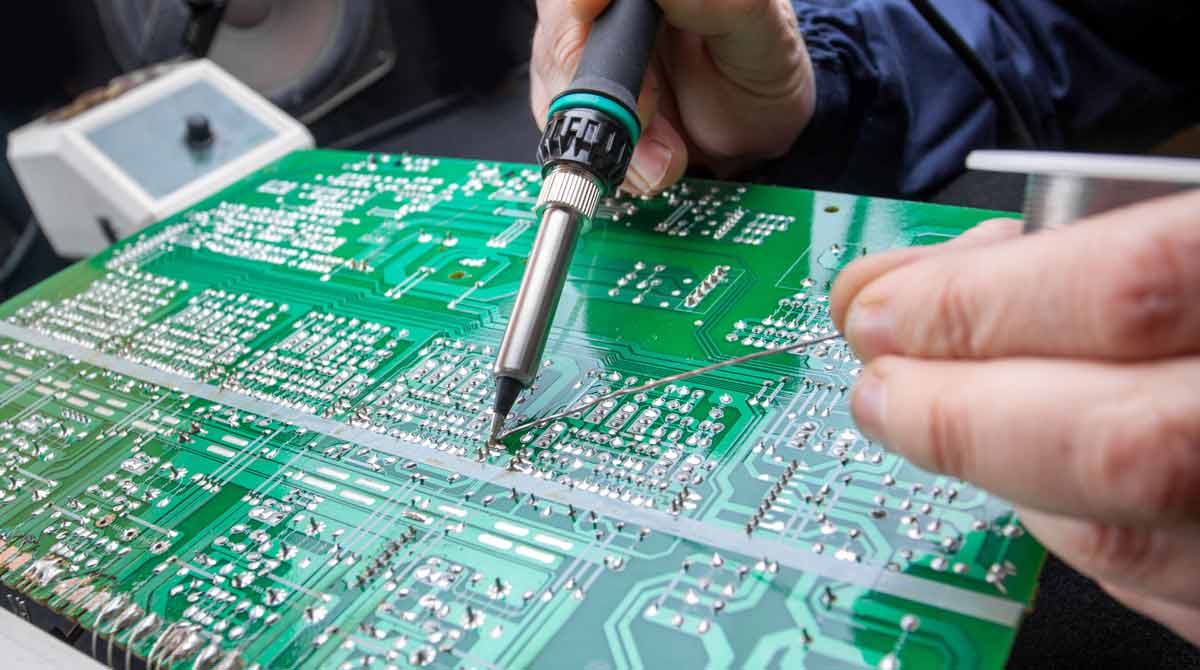

What does tin have to do with the price of tea in China? Tin is a relatively small market compared to the industrial copper and aluminum sectors, but it’s essential for soldering in electronics. With a surge of post-pandemic demand, tin is a red hot commodity in 2022.

“Tin has surged more than 90% to all-time highs on the London Metal Exchange, while near-dated contracts have been trading above futures for almost an entire year on the LME, in a condition known as backwardation that’s a hallmark sign that spot demand is exceeding supply.”

A New Commodity Squeeze Could Soon Rival Lumber’s Recent Historic Shortage

By January 26 of 2022, tin set yet another record high for the LME price of the hot cash metal at $44,200 per ton, before settling back to an impressive $42,500 after the dust had settled. That puts tin at almost double the price just one year ago.

Tin has been in the “backwardation” cycle for 250 days as of the December 1 Bloomberg report at the link above, a supply chain “squeeze” that ranked it just under the infamous lumber squeeze of 2021 and makes it one of the longest-running ever recorded in the commodities market.

Now Indonesia blames “administrative difficulties with exports permits” for falling tin exports at a time when prices are spiking and inventories are way down. Since record prices haven’t “put a dent in demand” as industry writer Mark Burton puts it, Asian tin producers including Indonesia, Malaysia, and Myanmar have everything to gain by tightening their holds. Indonesia’s largest tin producer, PT Timah, posted disappointing export numbers, down 49% in the first 9 months of 2021.

Malaysia Smelting Corporation is “looking into ending” their covid-related halt on sales”. When sales do resume, buyers in China’s Shanghai Futures Exchange will eagerly pay the new premium.

Isn’t that convenient? But tin isn’t the only “squeezed” metal in the 2022 supply chain. And once again the world is looking for Indonesia to get its mining act together and get some nickel on the table.

The Nickel Squeeze in 2022

A thriving stainless steel sector in China and the voracious EV battery sector everywhere else are the primary drivers of demand for nickel. Prices for the metal which has experienced “decades of underinvestment” are expected to go even higher in 2022, according to a January 24, 2022 report at oilprice.com.

As a result of these two combined drivers of demand for nickel, Goldman Sachs estimated that the global nickel market deficit reached 159,000 metric tons in 2021 after the bank had anticipated a surplus of 49,000 tons. Sachs and JP Morgan are both predicting smaller deficits this year in the 30- 40,000-ton range.

Even if the stainless steel sector cools off in China, the “electric revolution” in the automotive industry is expected to pick up the slack, replacing it as the number 1 driver of the world’s demand for nickel. In 2020 stainless steel accounted for 70% of the global demand while the battery industry accounted for just 10%.

Now, as the electric revolution gains traction with the world’s automotive consumers, demand from the battery industry is forecasted to accelerate “much more quickly” than in other industries, sectors such as home electronics that are also experiencing growth in demand.

American automaker Ford recently announced that it will be doubling production of the electric Ford F-150 Lightning in response to strong consumer demand. Ford’s decision comes at a time when 1 in 4 new cars sold in the UK are EVs, while sales for the battery-dependent “new energy vehicles” in the China megamarket jumped by 169%.

The nickel deficit is only expected to grow and that’s a potential headache for battery makers. So much so that it’s inspiring engineers to take a closer look at alternative battery chemistries including R&D in the up-and-coming LFP, (lithium iron phosphate) and sodium-ion technologies.

And there are other silver linings to the cash metals squeeze. As prices set new records, mining companies and automakers alike are more motivated to secure long-term supplies that make previously “unprofitable metal deposits” worth another look. And with Bloomberg projecting that global demand for the nickel supply will multiply by at least 16 times by 2030, that’s certainly a look worth taking.

About Resource Erectors

The human resource supply chain may be the most precious resource of them all as the heavy industry sector works to build a robust recovery in 2022. Resource Erectors has the heavy industry recruiting experience your company needs when it’s time to build the dream team you’ll need to succeed in the competitive sectors of 2022 such as mining, civil construction, aggregates, concrete, engineering, and construction materials.

Our decades of experience in matching the top qualified candidates to the companies that fit them best has resulted in over 85% of Resource Erectors candidates who are still contributing to the success of their companies 5 years later. We help you avoid the disruptions of a bad hire while eliminating the High Cost of Vacancies that pile up each day essential positions in your organization go unfilled.

If you’re an experienced, highly qualified, heavy industry professional, Resource Erectors maintains ongoing connections with the industry-leading companies in North America who are seeking your skills and talents today, so don’t hesitate to contact us when it’s time to make a strategic move up the professional career ladder.