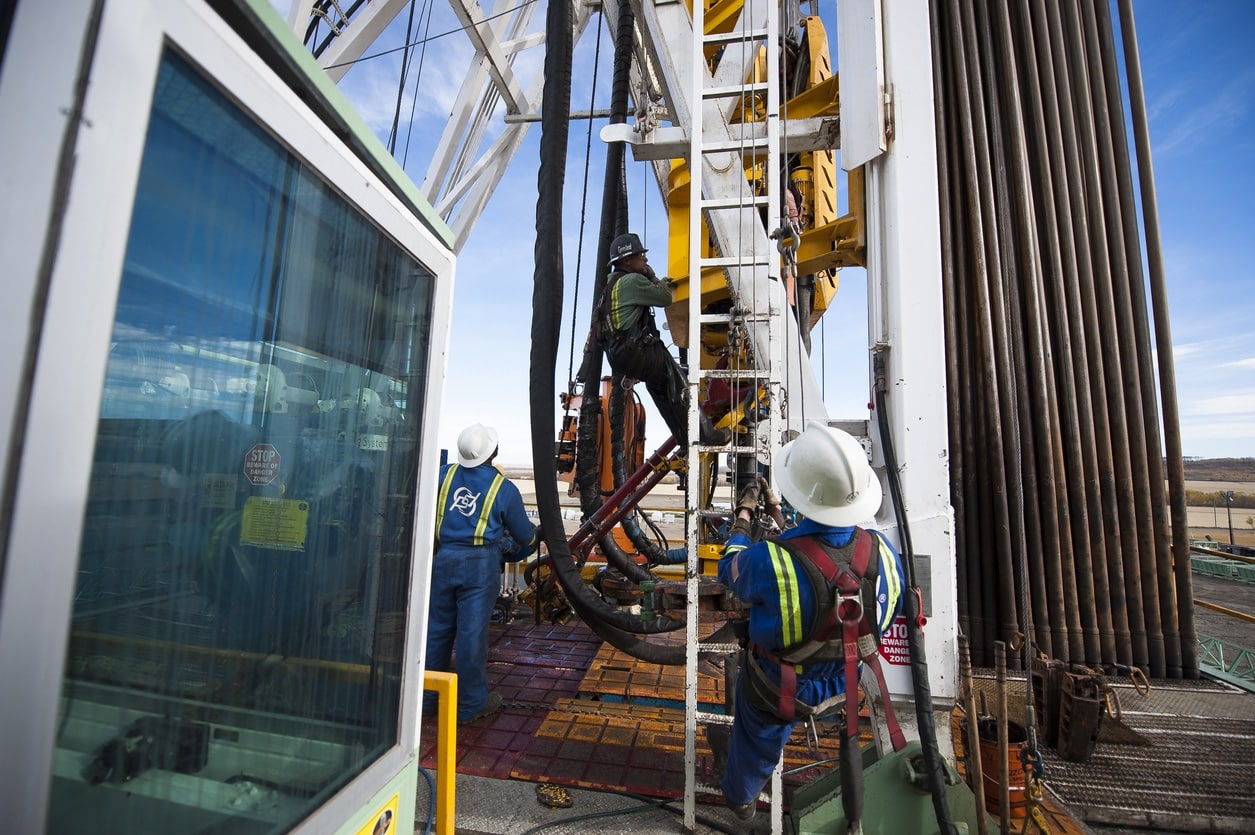

The US Fracking Sand Market Under More Pressure in 2020

Excess supply in the US frac-sand market has been beating down prices and depressing sand mining stocks by more than 70% in the past two years. A report at World Oil Magazine focused on the problem of a US frac-sand market “swimming in an excess of supply” just over a year ago in the April 2019 article by David Wethe.

Hydraulic fracking drove an oil- drilling boom that restored the US to the top spot as the world’s leading oil producer, overtaking Russia and Saudi Arabia in 2013. Since then the US has held the top spot for the past 6 years averaging 17.87 million barrels per day, enough oil to supply the needs of 18% of the world’s population.

Today the US is a net exporter of oil, thanks to hydraulic fracking technology and the oil-rich shale formations found in the “red-hot” Permian Basin oil deposits in Texas and New Mexico, as well as lucrative shale-bound oil patches in North Dakota. When oil prices plunged in 2014 the rush was on to develop economical fracking operations to pump shale oil, the least expensive technique for extracting the fuel.

But for the frac-sand sector, too much of a good thing is taking a toll. A deluge of frac-sand entrepreneurs launched dozens of mining operations to cash in on the boom and production soared by 50%. Frac-sand operations closer to the Permian Basin were stiff competition for the traditional “capital of frac-sand mining” in northwestern Wisconsin.

Even a year ago the frac-sand supply was characterized in Wethe’s report where he states that:

“For every grain of sand that explorers need to prop open a tiny crack in their oil-soaked rock, miners have roughly two grains to offer them.”- World Oil Magazine, April 3, 2019

Volatile Frac Sand Trends For 2020

At Resource Erectors, we reported on the frac-sand boom in West Texas back in the summer of 2018. We looked at possible growth in alternate markets for high-grade silica sand in the civil construction and automotive industries just last summer.

But in the post-coronavirus economy, 2020 is a whole new ball game and the flood of oil unleashed by the Russia-Saudi oil rivalry is yet another curveball for frac-sand miners.

While the coronavirus slowdown is a short-term problem with stimulus packages and government intervention mapping out a timely recovery on the horizon this summer, asset options advisors at Gordon Brothers warn that the Russia-Saudi price war may be long-lasting and “settling in for the long haul”.

Their April 2020 report “Frac Sand Production and Demand” reminds us that prior OPEC price wars have dragged on from 12 to 24 months.

As these two producers drive oil prices down to $22 for West Texas Intermediate crude, and a troubling single digit $4.18 in Alberta, Canada, the analysts at Gordon Brothers warn that “almost every oil play has been rendered unprofitable in North America”. With new drilling activity reduced to nearly zero over the next 3 to 6 months, the forecast for the frac sand sector is contraction and consolidation.

In March, frac sand market participants signaled a 20% pullback in volume.

Texas Brown vs Northern White Frac Sand

With preferences swinging to acceptable brown, or “Texas sand” conveniently mined right in the oil-rich Permian Basin, Northern White Sand mining could decline by up to 15 million tons in 2020.

Even though brown sand has lower crush resistance than high-grade Northern White sand, oil companies still prefer brown Texas sand now fulfilling 85% of demand for fracking. The cost of clogged wells is negated by the cost of transportation from remote northern sources, so the shortcomings of brown sand haven’t prevented it from penetrating the Northern White market which supplied 75% of demand as recently as 2018.

After the inevitable bust following the frac sand boom, analysts do have expectations for an ongoing frac sand market, but they’re predicting that the high cost of transportation makes it likely that Northern White sand will be entirely replaced in major shale plays such as the Permian Basin, Eagle Ford, Haynesville, and Oklahoma.

Northern White will hold its place in northern operations in Canadian oil and gas plays as well as the Bakken and Marcellus operations where suitable brown sand deposits are rare.

About Resource Erectors

At Resource Erectors, we keep a close eye on the industry trends that have a direct effect on your company’s human resource needs. As market trends shift, so does the workforce. We maintain recruiting connections with the top qualified professionals and industry-leading companies in mining, tunneling, civil construction, engineering, and manufacturing who are seeking their talents, skills, and experience.

When you’re ready to move up the career ladder or build your dream team, you’re ready for Resource Erectors. Please don’t hesitate to contact us today.