Engineering on the Moon: Can You Dig It?: Part 1

The mission challenge for engineering teams from NASA is clear, should you decide to accept it: “DESIGN, BUILD, AND TEST TERRESTRIAL ANALOG FULL-SCALE PROTOTYPES

The mission challenge for engineering teams from NASA is clear, should you decide to accept it: “DESIGN, BUILD, AND TEST TERRESTRIAL ANALOG FULL-SCALE PROTOTYPES OF ROBOTIC ICY REGOLITH EXCAVATION AND TRANSPORTATION SYSTEMS.”- NASA Break the Ice Challenge “Regolith” is the engineering term for “Moon dirt”, and when it comes to extracting value from dirt, […]

Total Effective Equipment Performance In 2022, as we move forward into a turbulent Q3 summer with energy costs spiking and demand for aggregates and essential “battery metals” surging to unprecedented global levels, reaching maximum potential production capacity is of the highest priority. For mining, manufacturing, aggregates, construction materials, and just about every other facet of […]

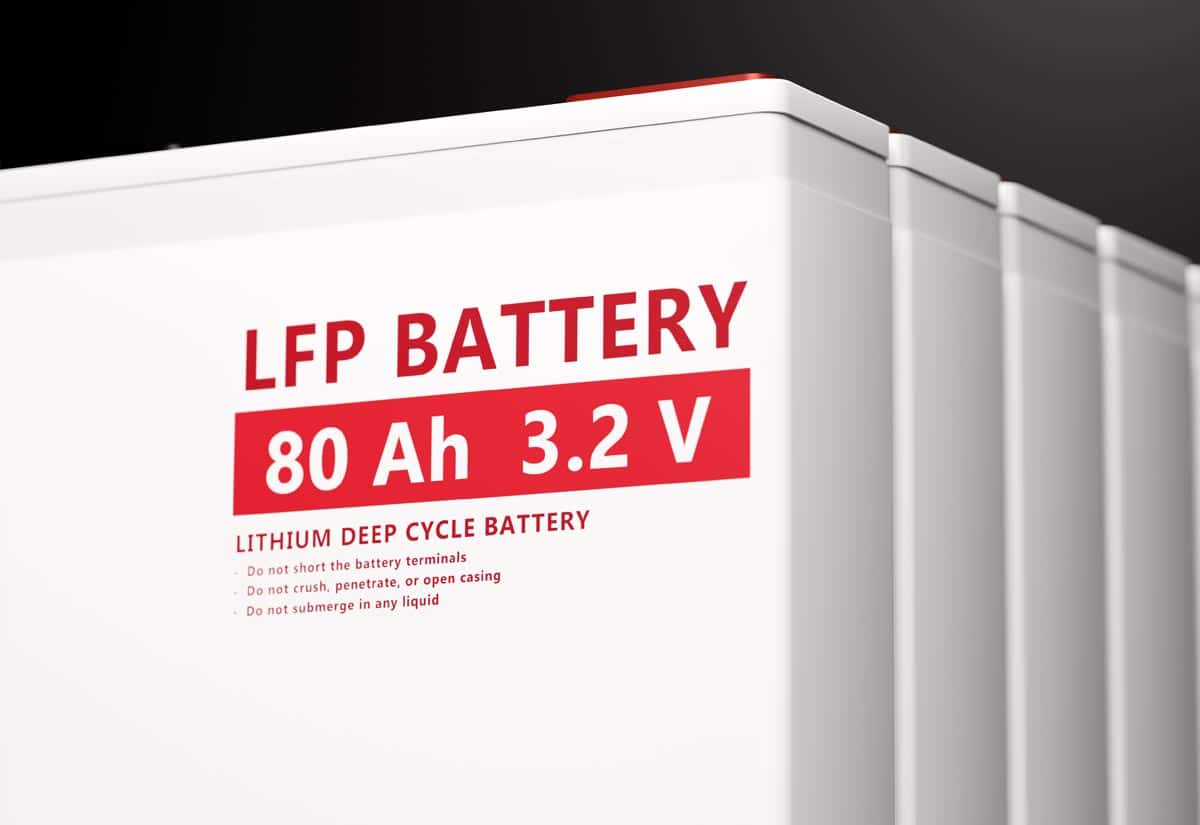

As escalating nickel prices had the world’s leading green innovator hollering for more sustainable nickel mining, it turns out that Elon Musk had some proven alternative battery technology up his sleeve. “Iron man Elon Musk places his Tesla battery bets” the April 27 Reuters report, calls it a “pivotal development” in EV manufacturing that […]

Elon Musk’s acquisition of Twitter is sending shock waves throughout the social media world. But what effects will his 43 billion dollar investment have on the rest of the Musk-China mega-mine empire? Elon Musk financed about 50% of his controversial Twitter buyout deal with a timely Tesla stock sale. Can innovator Musk unlock Twitter […]

“The calcium carbonate market in North America is poised to grow by 9168. 51 thousand tons during 2022-2026 progressing at a CAGR of 4.5”- April 13,2022 Globe Newswire at Yahoo Finance Resource Erectors Q2 Industry Watch April 2022 Calcium carbonate is one of the unsung essential minerals that’s been part of our daily lives […]

Underground Mining Will Always Be a Challenge-Part 2 As the global economy transitions to the brave new “green giant” economy, demand in 2022 for underground mined resources is skyrocketing. Many heavy industry engineers are estimating that global demand for essential MMM, (Mined Metals and Minerals) will increase by a factor of at least 10 […]

“All energy-producing machinery must be fabricated from materials extracted from the earth. No energy system, in short, is actually “renewable,” since all machines require the continual mining and processing of millions of tons of primary materials and the disposal of hardware that inevitably wears out. Compared with hydrocarbons, green machines entail, on average, a […]

Producers of concrete, steel, lead, zinc, copper, and just about any other material essential to building and maintaining a robust infrastructure are the industrial scapegoats continuously under fire from the not so jolly Green Giant of global environmental policies. Heavy industry PR in the Green Giant era today, focuses on exorcising the now universally […]

Resource Erectors Industry Watch: February 2022 Part 1 The consensus in the industrial world by February 2022 seems to regard 2021 as the year when companies across the board “got serious” about hitting ambitious Scope 1 and Scope 2 “carbon-zero” benchmarks. Corporations are ante-ing up with millions on the green energy table backed up […]

The fragility of the global metals supply chain exposed by the pandemic shutdowns will continue to be the leading factor contributing to uncertainty in industries across the board. Now as the scramble to recover continues in 2022, the global metals supply chain could be tightening even further.

Hydrogen vs. Lithium: Let’s get ready to rumble! Last year we witnessed a notorious, knock-down-drag-out, public relations battle between two of the world’s most powerful and influential green energy moguls; even though the two billionaire contenders were never in the same room. Now the hydrogen sector of the green energy industry is swinging back hard.

Resource Erectors Industry Watch Q4 2021 24/7 optimized production is the rule in construction aggregates rather than the exception now. Aggregate operations by the end of 2021 are under the gun and have no time for downtime. Not with a market share of nearly $74 billion on the table over the next 5 years. […]

The mission challenge for engineering teams from NASA is clear, should you decide to accept it: “DESIGN, BUILD, AND TEST TERRESTRIAL ANALOG FULL-SCALE PROTOTYPES

Total Effective Equipment Performance In 2022, as we move forward into a turbulent Q3 summer with energy costs spiking and demand for aggregates and essential

As escalating nickel prices had the world’s leading green innovator hollering for more sustainable nickel mining, it turns out that Elon Musk had some

Elon Musk’s acquisition of Twitter is sending shock waves throughout the social media world. But what effects will his 43 billion dollar investment have

“The calcium carbonate market in North America is poised to grow by 9168. 51 thousand tons during 2022-2026 progressing at a CAGR of 4.5”-

Underground Mining Will Always Be a Challenge-Part 2 As the global economy transitions to the brave new “green giant” economy, demand in 2022 for

“All energy-producing machinery must be fabricated from materials extracted from the earth. No energy system, in short, is actually “renewable,” since all machines require

Producers of concrete, steel, lead, zinc, copper, and just about any other material essential to building and maintaining a robust infrastructure are the industrial

Resource Erectors Industry Watch: February 2022 Part 1 The consensus in the industrial world by February 2022 seems to regard 2021 as the year

The fragility of the global metals supply chain exposed by the pandemic shutdowns will continue to be the leading factor contributing to uncertainty in

Hydrogen vs. Lithium: Let’s get ready to rumble! Last year we witnessed a notorious, knock-down-drag-out, public relations battle between two of the world’s most powerful

Resource Erectors Industry Watch Q4 2021 24/7 optimized production is the rule in construction aggregates rather than the exception now. Aggregate operations by the

© 2025 Resource Erectors