Biden’s Green Energy Policies Put a Huge Dent in the US Aluminum Supply

High-Cost Energy Crunch Shuts Down Century Aluminum Plant in 2022 At Century Aluminum, 600 laid-off American workers in Hawkesville, Kentucky are paying the immediate penalty

High-Cost Energy Crunch Shuts Down Century Aluminum Plant in 2022 At Century Aluminum, 600 laid-off American workers in Hawkesville, Kentucky are paying the immediate penalty for the Biden administration’s aggressive push to green energy. With natural gas prices tripling under the Biden regime, the second largest US aluminum mill has gone idle, shutting down due […]

American Fuel & Petrochemical Manufacturers (AFPM) Catching Heat Over the Cold Hard Facts About Russian Crude Imports AFPM is “springing into action” this March, in the nation’s capital. The Washington DC-based organization is self-described as a, “leading trade association representing the makers of the fuels that keep Americans moving and the petrochemicals that are the […]

“The cost of crude oil — and gasoline— began to climb over the past month as Putin massed forces on the Ukrainian border. The diplomatic back-and-forth has whipsawed financial and commodity markets as investors try to price in what an armed conflict and U.S. sanctions against Russia would mean for the global economy.”- US News […]

The Industrial Green Giant in 2022 Part 3 at Resource Erectors It wasn’t too long ago that we were wondering whatever happened to CCT developments, the Clean Coal Technology that yanks the green rug out from under the rock-solid feet of the not-so-jolly global Green Giant pushing a “green agenda” based on non-science and […]

Producers of concrete, steel, lead, zinc, copper, and just about any other material essential to building and maintaining a robust infrastructure are the industrial scapegoats continuously under fire from the not so jolly Green Giant of global environmental policies. Heavy industry PR in the Green Giant era today, focuses on exorcising the now universally […]

Resource Erectors Industry Watch: February 2022 Part 1 The consensus in the industrial world by February 2022 seems to regard 2021 as the year when companies across the board “got serious” about hitting ambitious Scope 1 and Scope 2 “carbon-zero” benchmarks. Corporations are ante-ing up with millions on the green energy table backed up […]

Resource Erectors Industry Watch Q4-December 2021 The industry watchers here at Resource Erectors were happy to see the 11 November press release from construction materials and energy industry giant Saint-Gobain, announcing a substantial 400 million USD investment earmarked for expanding the US gypsum industry and more in the domestic construction materials sector. According to the […]

Resource Erectors Industry Watch Q4 2021: What a difference a year makes. Last year in October 2020, we reported that President Trump had rightly declared a national emergency in the US mining industry to secure reliable domestic mineral and battery metal resources, all to meet explosive demand in the brave new green world. Earlier in […]

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices are presently at all-time highs and set to continue on their upward trajectory as demand continues to outstrip supply.”- Battery Metals Supply Shortage – Miners Win, Lithium-Ion Battery Makers Lose […]

Industry Watch at Resource Erectors Q4 2021 And we thought Jeff Bezos’ benchmark order for 100,000 Amazon delivery EVs by 2030 was ambitious? Now, like a Phoenix rising from the ashes, recently bankrupt Hertz has announced that it will buy 100,000 Tesla Model 3 small cars by the end of 2022. In accordance with […]

“With each new pledge and plan to accelerate renewable energy deployment and build the homegrown electric auto industry of tomorrow, we are financing enormous mineral demand while doing little more than paying lip service to building the industrial base needed to supply it.”- Katie Sweeney-Billings Gazette

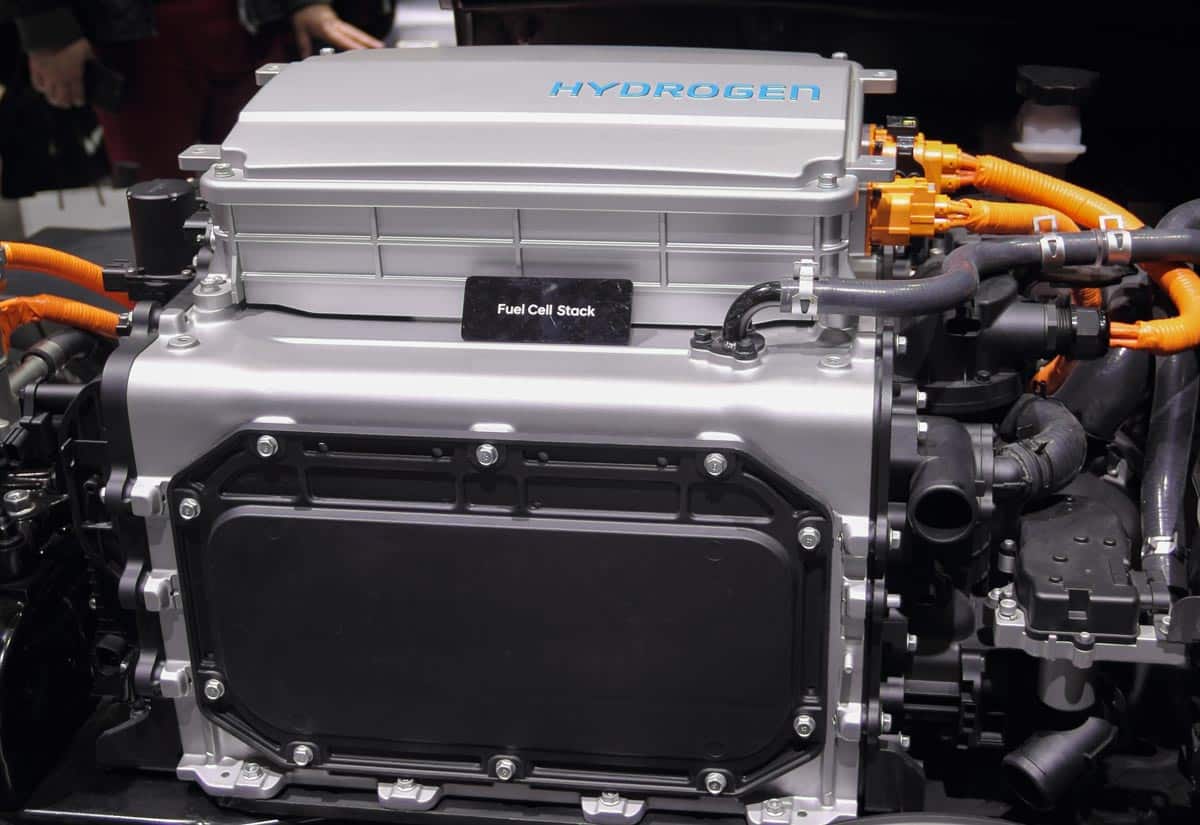

In a Resource Erectors blog last May we featured the showdown between lithium lothario Elon Musk and Australia’s mining and energy icon, billionaire Andrew Forrest. In that case the billionaire standoff centered on hydrogen “blue gas” as a much more plentiful fuel for powering the proposed all-electric fleets for the world’s biggest EV customer, […]

High-Cost Energy Crunch Shuts Down Century Aluminum Plant in 2022 At Century Aluminum, 600 laid-off American workers in Hawkesville, Kentucky are paying the immediate penalty

American Fuel & Petrochemical Manufacturers (AFPM) Catching Heat Over the Cold Hard Facts About Russian Crude Imports AFPM is “springing into action” this March, in

“The cost of crude oil — and gasoline— began to climb over the past month as Putin massed forces on the Ukrainian border. The diplomatic

The Industrial Green Giant in 2022 Part 3 at Resource Erectors It wasn’t too long ago that we were wondering whatever happened to CCT

Producers of concrete, steel, lead, zinc, copper, and just about any other material essential to building and maintaining a robust infrastructure are the industrial

Resource Erectors Industry Watch: February 2022 Part 1 The consensus in the industrial world by February 2022 seems to regard 2021 as the year

Resource Erectors Industry Watch Q4-December 2021 The industry watchers here at Resource Erectors were happy to see the 11 November press release from construction materials

Resource Erectors Industry Watch Q4 2021: What a difference a year makes. Last year in October 2020, we reported that President Trump had rightly declared

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices

Industry Watch at Resource Erectors Q4 2021 And we thought Jeff Bezos’ benchmark order for 100,000 Amazon delivery EVs by 2030 was ambitious? Now,

“With each new pledge and plan to accelerate renewable energy deployment and build the homegrown electric auto industry of tomorrow, we are financing enormous mineral

In a Resource Erectors blog last May we featured the showdown between lithium lothario Elon Musk and Australia’s mining and energy icon, billionaire Andrew

© 2025 Resource Erectors