Massive Mineral Deposits Making Industry Headlines in 2023

The mining industry’s top geologists have already stepped up to the plate and hit home runs with major league mineral discoveries in 2023… But

The mining industry’s top geologists have already stepped up to the plate and hit home runs with major league mineral discoveries in 2023… But will unqualified politicians get out of the way and let the engineers round the bases to supply the grand slam demand for phosphate rock they themselves have created with their […]

“Heavy industry is a type of business that involves large-scale undertakings, big equipment, large areas of land, high cost, and high barriers to entry. It contrasts with light industry, or production that is small-scale, can be completed in factories or small facilities, costs less, and has lower barriers to entry.”- Investopedia – Heavy Industry: […]

In a devastating critique, the PNAS [Proceedings of the National Academy of Science] report warned; “Policy makers should treat with caution any visions of a rapid, reliable, and low-cost transition to entire energy systems that rely almost exclusively on wind, solar, and hydroelectric power.” Experts Debunk 100% Renewables Decarbonization- Power Magazine Engineers know […]

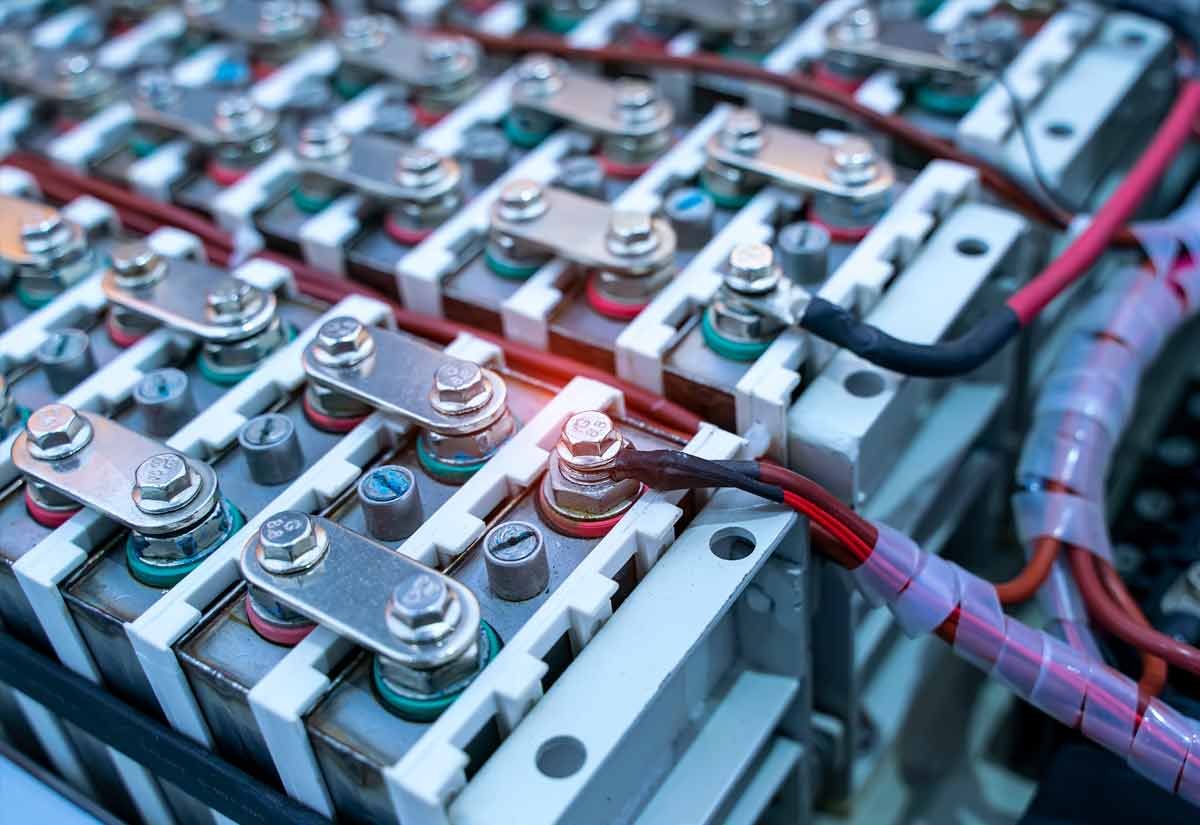

“Phosphate in North America is depleting. In terms of purified phosphoric acid (PPA), you cannot create any more of it. It’s already being used for food. There’s not a lot of extra capacity for the battery, but batteries are going to require a lot more PPA,”- First Phosphate CEO John Passalacqua. There Ain’t […]

“We were told that the IRA would give us cheap ‘green’ energy for ‘only’ $400 billion in subsidies. In reality, the IRA has a limitless price tag due to its; 1) limitless number of years, 2) limitless dollars per year, 3) limitless harm to our grid.” fossil-fuel expert Alex Epstein “- How Greening the […]

No, we’re not talking politics here, no matter how well that moniker could apply to so many greenster “thought leaders” in their super-hyped quest for “carbon neutrality”. As we spring into April 2023, Green Giant Google is awash with stories about the recent breakthrough scientists in Japan achieved, and it’s not an April fools joke. […]

Green transition nations are seeing red over China’s rusty supply chain. In 2023 “delinking” from China is the move to make. “Using the Global 500 list as a benchmark, the US and China still pack about equal punch, though the weird hybrid of “communist capitalism” has OEMs in the rest of the world looking […]

A new book just out on the hazardous world of primitive cobalt mining in the DRC, the world’s largest cobalt-producing nation, is having quite an impact on the 2023 mining sector. Not to mention the all-electric,carbon-free, greentopia of 2030 envisioned by green thought leaders such as our favorite engineer/ entrepreneur Elon Musk, who made […]

In 2023 the heavy industry sector continues to meet the challenges of a perfect supply and demand storm consisting of a robust 21st-century construction boom while complying with the restrictive production inhibiting “green” policies often founded on obsolete 1970s environmental false alarms. Building Demand For Essential Resources to Support a Population of 10 Billion […]

So far in 2023 we’ve been keeping an interested eye on the subtle shift in the dominant green narrative here at Resource Erectors. In 2023 we’re finally seeing some corporate counter-punching and real-world advancements in more practical “drop-in” solutions for a truly green transition. The green shift toward hydrogen and fuel agnostic diesel power […]

Are FCEVs a practical “drop-in” technology for the Green Transition? While the diesel sector powers up in 2023 with renewable biofuels and fuel-agnostic internal combustion horsepower, and new EV wheel loader production investments from industry leaders such as Volvo CE, the hydrogen sector isn’t far behind. Some may even say that Fuel Cell Electric […]

As a refugee from communism herself, Ayn Rand saw the disastrous consequences of the global socialist mindset in action, and the degeneration it can cause in a free market republic, way back in the 1930s. Atlas Shrugged is her prophetic blueprint of the inevitable, logical consequences of illogical socialist thinking. Rand takes the “if […]

The mining industry’s top geologists have already stepped up to the plate and hit home runs with major league mineral discoveries in 2023… But

“Heavy industry is a type of business that involves large-scale undertakings, big equipment, large areas of land, high cost, and high barriers to entry.

In a devastating critique, the PNAS [Proceedings of the National Academy of Science] report warned; “Policy makers should treat with caution any visions of

“Phosphate in North America is depleting. In terms of purified phosphoric acid (PPA), you cannot create any more of it. It’s already being used

“We were told that the IRA would give us cheap ‘green’ energy for ‘only’ $400 billion in subsidies. In reality, the IRA has a

No, we’re not talking politics here, no matter how well that moniker could apply to so many greenster “thought leaders” in their super-hyped quest for

Green transition nations are seeing red over China’s rusty supply chain. In 2023 “delinking” from China is the move to make. “Using the Global

A new book just out on the hazardous world of primitive cobalt mining in the DRC, the world’s largest cobalt-producing nation, is having quite

In 2023 the heavy industry sector continues to meet the challenges of a perfect supply and demand storm consisting of a robust 21st-century construction

So far in 2023 we’ve been keeping an interested eye on the subtle shift in the dominant green narrative here at Resource Erectors. In

Are FCEVs a practical “drop-in” technology for the Green Transition? While the diesel sector powers up in 2023 with renewable biofuels and fuel-agnostic internal

As a refugee from communism herself, Ayn Rand saw the disastrous consequences of the global socialist mindset in action, and the degeneration it can

© 2025 Resource Erectors