LATEST POSTS

Is There an Infrastructure Spending Bone Under All That Trillion Dollar Green Pork?

|

Resource Erectors Industry Watch Q4 2021: What a difference a year makes. Last year in October 2020, we reported that President Trump had rightly declared a national emergency in the US mining industry to secure reliable domestic mineral and battery metal resources, all to meet explosive demand in the brave…

aggregate mining jobs, Aggregates, construction aggregate markets, Mining, precast concrete, ready-mix concrete, trending news

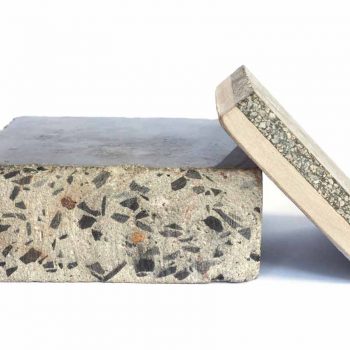

Advanced Composites to Meet Demand in Mining, Concrete, & Aggregates

|

Resource Erectors Industry Innovation Watch Q4 2021 Unless you’ve been living under an uncrushed rock yourself, it’s not breaking news for heavy industry professionals that the demand for metals, minerals, and construction aggregates is reaching unprecedented levels in industrial sectors across the board. Affected industries range from precast concrete…

The Red Hot Battery Metal Market: Firing Up the Mining Industry For 2022

|

“Benchmark’s Lithium Carbonate Price EXW China (battery) has increased 313.33% since this time last year, reaching RMB 185,000/tonne ($28,675) in mid-October. Lithium carbonate prices are presently at all-time highs and set to continue on their upward trajectory as demand continues to outstrip supply.”- Battery Metals Supply Shortage – Miners…

Evergrande and Red China in the Red: Can China Deliver in 2022?

|

Resource Erectors Q4 2021-2022 Heavy Industry Review Part 1 China is facing soaring raw material costs, weakened manufacturing, a widespread power shortage, and the explosive Evergrande Effect in the real estate sector. This November the inevitable Evergrande collapse looms large and ripple effects from China are beginning to rumble…

100,000 EVs for Hertz by 2022: Piling on Demand for Mined Battery Metals

|

Industry Watch at Resource Erectors Q4 2021 And we thought Jeff Bezos’ benchmark order for 100,000 Amazon delivery EVs by 2030 was ambitious? Now, like a Phoenix rising from the ashes, recently bankrupt Hertz has announced that it will buy 100,000 Tesla Model 3 small cars by the end…

Fast Tracking the Mining and Quarry Digital Transition With 5G Private Networks in 2021

|

Innovation Watch at Resource Erectors Part 3 At Resource Erectors the 5G rollout has been one both we and the mining industry have been anticipating for years now if not for decades. As far as innovations go, the 5G private network rollout is the tech story of 2021, especially for…